Aetna Medicare Supplemental Insurance Plan G

Aetna Medicare Supplement Plan G Benefits. Aetna is the brand name for insurance products issued by the subsidiary insurance companies controlled by Aetna Inc.

Medicare Supplement Insurance Aetna Medicare

Government or the Federal Medicare Program.

Aetna medicare supplemental insurance plan g. Same benefits apply once calendar-year deductible is paid. Aetna Plan G is a great bargain for many people. 1 Plans F and G also have a high deductible option which require first paying a plan deductible of 2300 before the plan begins to pay.

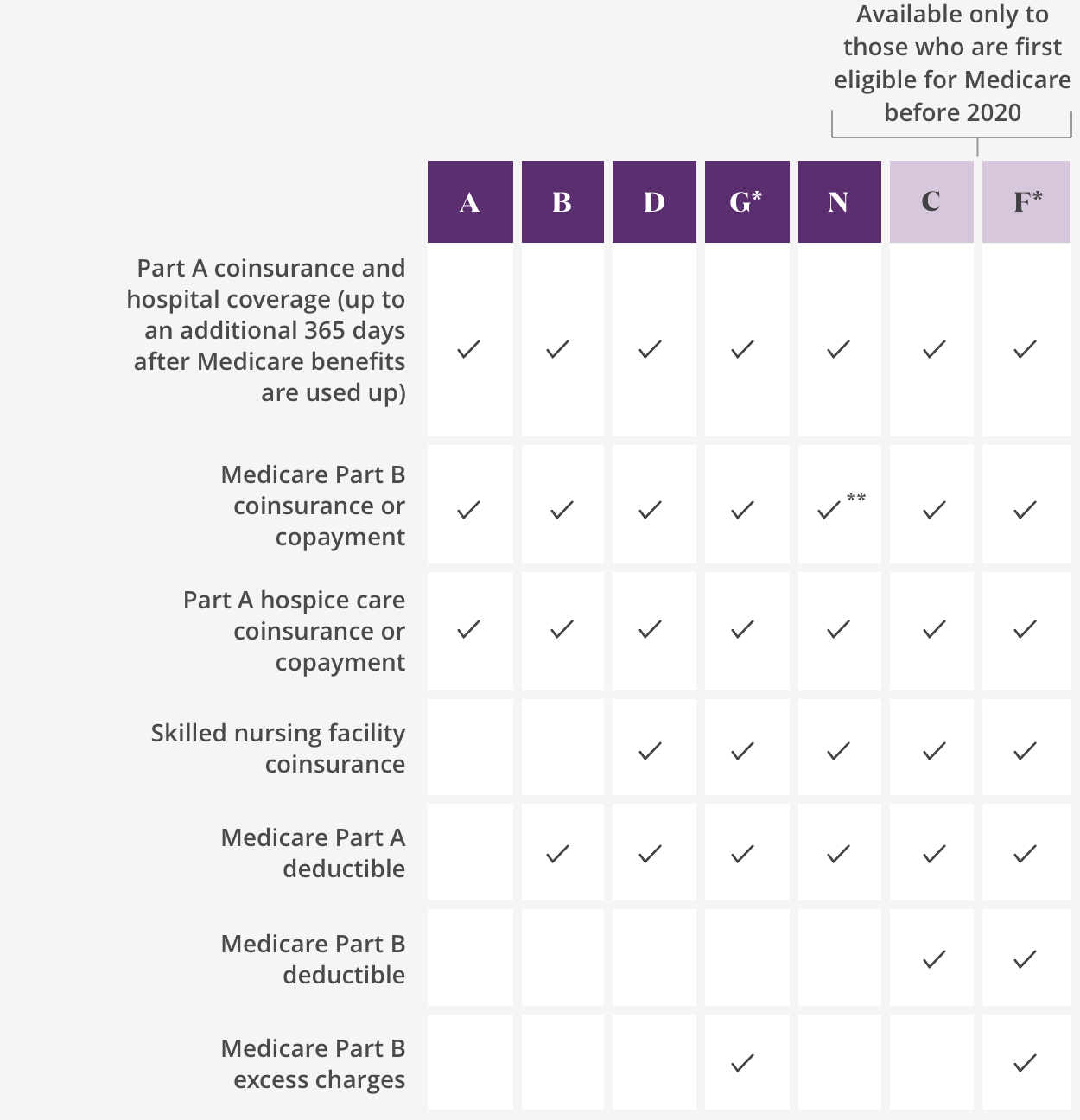

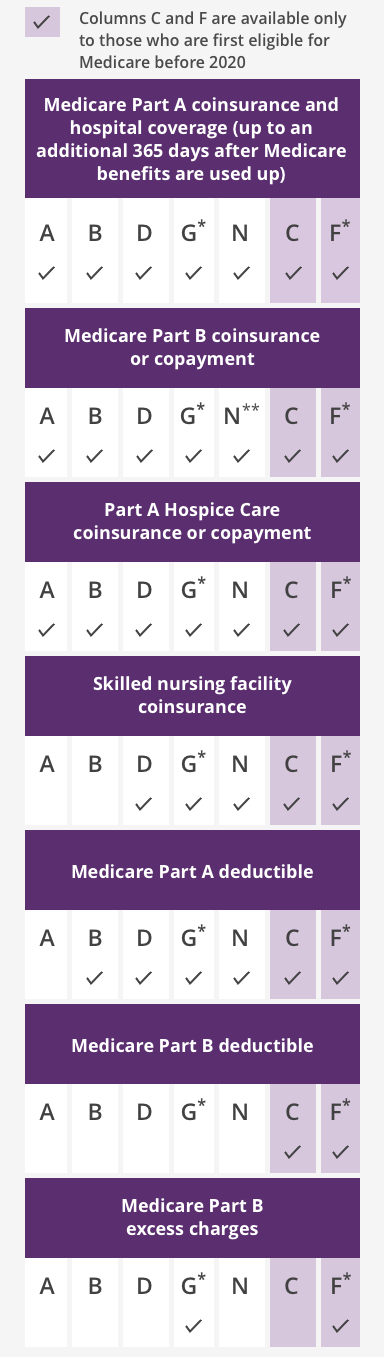

Plan C Plan F High-deductible Plan F and Plan G are also available. Medicare Part B excess charges. Plan A is the most basic Medigap plan.

Same benefits apply once calendar-year deductible is paid. Aetna Medicare Supplement Plan G offers all the benefits of Plan F except it doesnt cover the Part B deductible. 2019 and earlier Aetna PDP members Medicare Supplement Insurance.

Each plan gives seniors comprehensive coverage and are among the most robust of all supplements sold by Aetna Health and Life Insurance Co. Aetna Medicare Supplement Plan C covers everything that Plan F does except for Part B excess charges. Folks who buy an Aetna Medicare Supplement Plan G pay a fixed monthly premium and an annual deductible of 2021 per year at the doctors office.

The Aetna Plan G is a top choice among our clients. Now lets explore the different types of Medigap plans that Aetna offers. In fact any insurance company selling Medigap plans.

The Medicare Supplement Insurance Plans are insured by Continental Life Insurance Company of Brentwood Tennessee an Aetna Company Aetna American Continental Insurance Company Aetna Aetna Health and Life Insurance Company Aetna Aetna Life Insurance Company Aetna or Aetna Health Insurance Company. Private insurance companies must have particular coverage in Advantage plans that provide coverage for Parts A and B Medicare plans for. What is covered by Medicare Supplement Plan G.

The Medicare Supplement Insurance plans are insured by Aetna Health and Life Insurance Company Aetna. Although private insurance companies such as Aetna offer Advantage and Supplement plans the Medicare organization still regulates it. Not connected with or endorsed by the US.

Plan G Plan N High-deductible Plan F and Plan G are also available. Aetna Life Insurance Company Outline of Medicare Supplement Coverage. Aetna Medigap Medicare Supplement Plan G has become one of the most popular Medigap plans with consumers within the United States.

In some states they have even averaged rate decreases going back 5 years on their plan G. Aetnas Medicare Supplement Plan G has a premium discount of 7 if someone in your home is also on one of its plans. Medigap Plan G is a supplemental plan that works with original Medicare.

This high deductible plan pays the same benefits as Plan F after one has paid a calendar year 2180 deductible. Medicare Supplement Plan A. Besides offering affordable Medicare Supplement plans the company also focuses on promoting health and wellness in their communities by supporting non-profit organizations and implementing grants programs.

Medicare Supplement Plan G is nearly identical to a Plan F policy. The small difference is that Plan G makes the beneficiary pay the Medicare Part B deductible out-of-pocket. Both Plans C and F are only available to beneficiaries who were first eligible for Medicare prior to January 1 2020.

Plan G Plan N. The following plans are available only to those who are first eligible for Medicare before 2020. Benefit Plans A B F G and N are Offered Plan F also has an option called a high deductible Plan F.

High-deductible Plan F and Plan G are also available. Aetna is the brand name for insurance products issued by the subsidiary insurance companies controlled by Aetna Inc. They have been getting approved for rate decreases making them even more competitive.

Its only different from Plan F because it wont pay the Part B deductible. This includes a spouse someone with whom you have a civil union partnership or anyone who has lived with you for 12 months or more. There are no copays with Plan G at the doctor or specialist.

High deductible plan G does not cover the Medicare Part B deductible. Once the plan deductible is met the plan pays 100 of covered services for the rest of the calendar year. 45 5 Excellent Aetna provides Medicare Supplement insurance plans F G and N for individuals groups and families.

The availability of household discounts could otherwise vary from state to state. At the time of writing this Aetna Medicare supplement plan G is one of the most competitive plan Gs in many states across the country. In 2020 this deductible is only 198 so if its possible to save that much on payments during the year Aetna Plan G can be a good deal.

Same benefits apply once calendar-year deductible is paid. Aetna Medicare Supplement G offers robust coverage and a wide network for its members. What Benefits Does Medicare Supplement Plan G From Aetna Include.

Benefits from high deductible Plan F will not begin until out-of-pocket expenses exceed 2180. The following plans include Medicare Part A coinsurance and hospital coverage up to an additional 365 days after Medicare benefits are used up. Its designed to help with these things in addition to the basic Medicare benefits that you can enjoy while enrolled in Medicare Part A and Part B.

Aetna Medicare Supplements Aetna Medicare Supplement Reviews 2021

Medicare Supplement Insurance Aetna Medicare

Aetna Plan G Aetna Medicare Plan G Options Rates Hea

Compare Aetna Medicare Supplement Plan G Sample Rates Medigap G