Fers Social Security Supplement

The annuity supplement portion of your monthly payment is subject to an annual earnings test. Because the earliest age youd be eligible for Social Security is age 62 this supplement is meant to bridge the gap of retirement income for those who retire before age 62.

Fers Supplement Plan Your Federal Retirement

This money is provided by the federal government automatically at retirement and is used as supplemental monthly income.

Fers social security supplement. Would be used by the Social Security Administration to compute a Social Security benefit including the maximum reduction for early retirement under Social Security. How is our individual FERS special retirement supplement rate calculated. How is FERS Social Security supplement calculated.

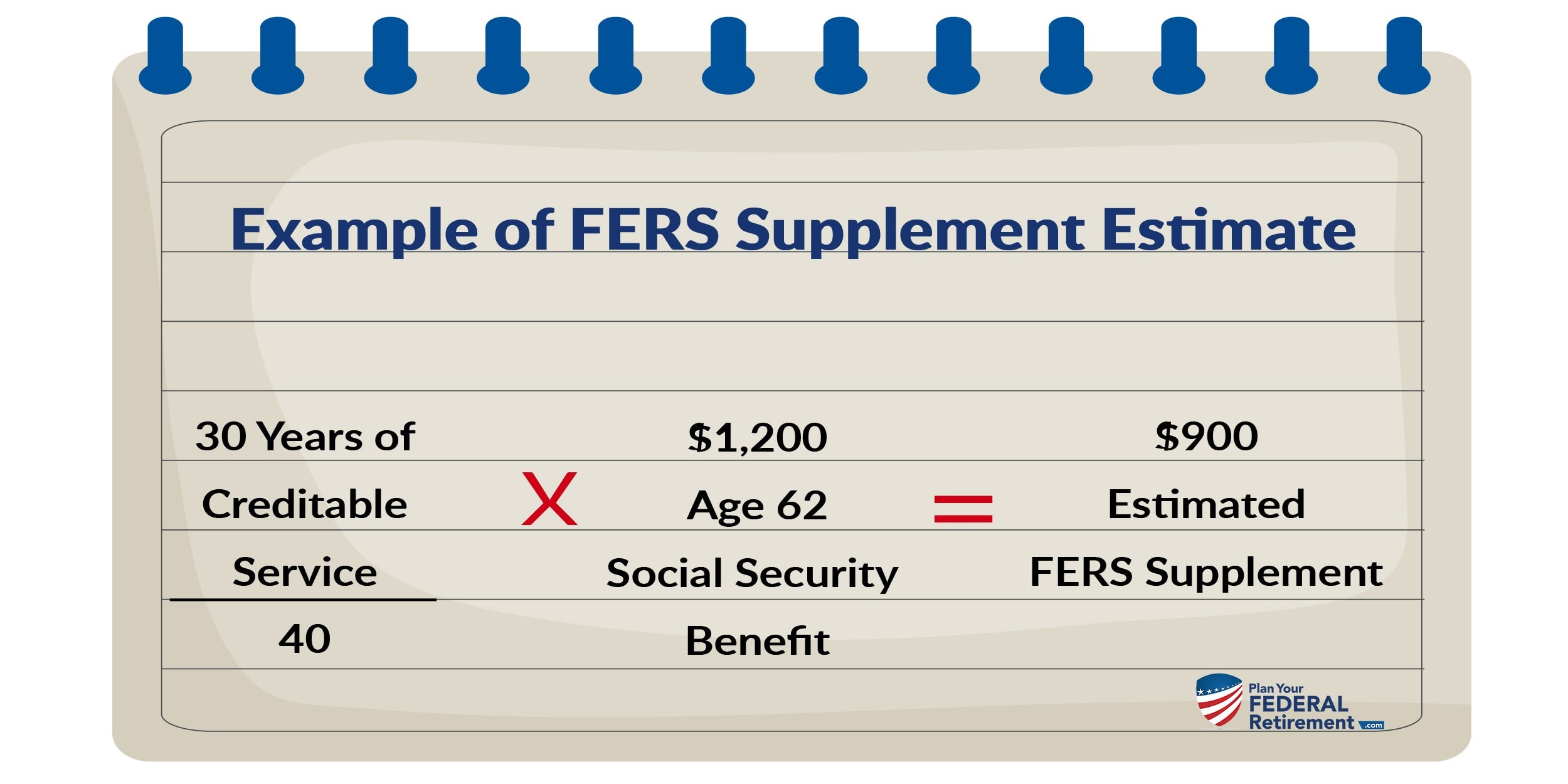

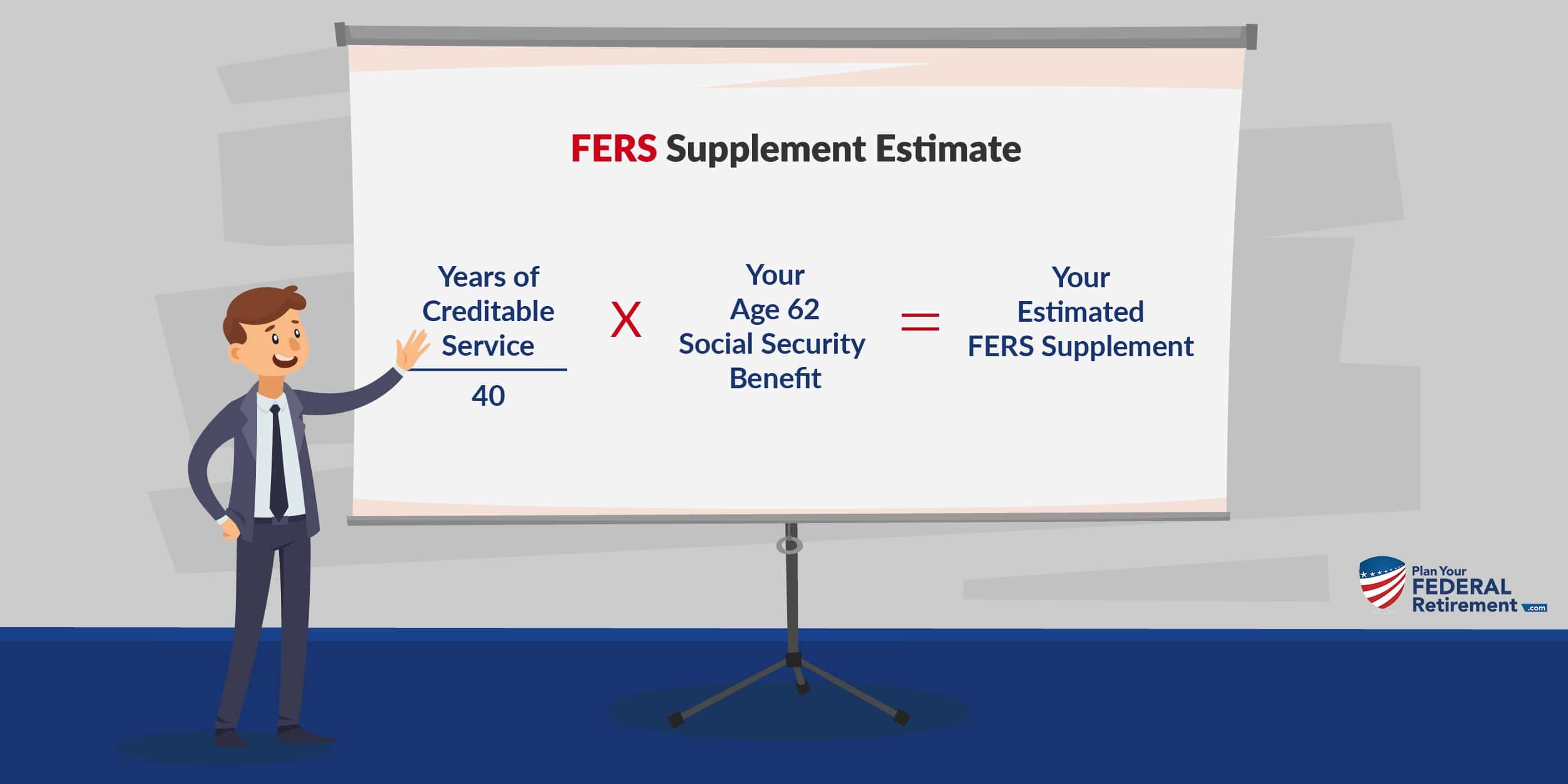

The FERS supplement is one of the benefits included when FERS was implemented that allows federal employees to plan for retirement with similar age and service requirements as employees who retire. Take the estimate of your Social Security benefit at age 62 provided by the Social Security Administration multiply it by your years of actual FERS service and divide by 40. The supplement is calculated as if you were 62 years old and fully insured for a Social Security benefit when the supplement begins.

It is designed to help bridge the money gap for certain FERS who retire before age 62. The FERS SRS is designed to bridge the gap until 62. It is designed to save the money to retire to various FERS who are retiring before the 62nd.

For example if your estimated. You have received the FERS Annuity Supplement Survey to determine if you earned more than then exempt amount 18240 for 2020 set by the Social Security Administration. Fourth multiply the result of the third step by a fraction to approximate the proportion of a full career Social Security benefit earned under FERS.

For example if the estimated benefit of your entire Social Security career is 1000 and you have been working 30 years under FERS we divide 30 by 40 75. However the SRS will stop at age 62 when you are ELIGIBLE for Social Security benefits regardless if you actually draw Social Security at that time. Alternatively you can qualify for the FERS Supplement if you have 20 years of creditable service and are age 60.

The FERS Supplement is also called the Special Retirement Supplement or SRS. The Special Retirement Supplement is a bridge given to FERS employees who retire before the age of 62 when they become eligible for Social Security. This month we want to address the lesser-known and often more confusing special retirement supplement SRS also known as the FERS Retiree Annuity Supplement for eligible FERS participants.

It ends when you reach age 62 and is subject to an earnings test. It is called the FERS supplement the Social Security Supplement or even the Special Retirement Supplement. FERS employees are covered by a three-part retirement system an annuity Social Security and the Thrift Savings Plan.

FERS employees who retire After their Minimum Retirement Age MRA with 30 years of service will receive a Special Retirement Supplement which is paid as an annuity until you reach age 62 and become eligible for Social Securit y. FERS Retirees Are Eligible to Collect Social Security and a Supplement if They Retire Early. The SRS is paid to FERS employees who retire on an immediate unreduced annuity before reaching age 62 when they become eligible for Social Security benefitsif you retire.

The FERS supplement is also called the Special Pension Supplement or SRS. This time I want to explain the special retirement supplement. Social Security is expected to be a part of the retirement package of FERS employees.

Divide the Social Security benefit estimate by 40 and multiply the result by the number of years youve been employed under FERS rounded to the nearest full year. This benefit provides a source of income that mimics the age 62 Social Security benefit but is computed using only civilian federal service creditable to the FERS retirement benefit. But not all FERS are eligible to receive the supplement.

It mimics the age 62 Social Security benefit but its computed using only civilian federal service creditable to your FERS retirement benefit. The supplement like Social. The supplement bridges the time between the onset of retirement and the age you qualify for Social Security retirementwhich is generally 62.

Money received from your FERS pension the TSP or similar retirement accounts does not count as earned income so it will not be considered in the reduction of your SRS benefit. It will supplement your missing social security income until you are 62 years old. In fact the reason FERS was created was to bring federal employees under the Social Security system.

It will supplement your missing Social Security income until you reach age 62. Earlier this month we talked about the FERS Basic Benefit Plan and social security payments and the potential impact on net income after taxes. Lets dig into how it works.

Eligibility for the FERS Social Security Supplement To collect the FERS Supplement you must have at least 30 years of creditable service and meet your Minimum Retirement Age. Congress created a supplemental payment to tide over FERS retirees who chose to retire before they hit the age of eligibility for Social Security.

Fers Special Retirement Supplement Retirement Benefits Instituteretirement Benefits Institute

Fers Annuity Supplement Reductions Plan Your Federal Retirement

Fers Supplement Plan Your Federal Retirement

Fers Social Security Supplement What You Should Know Divergent Planning